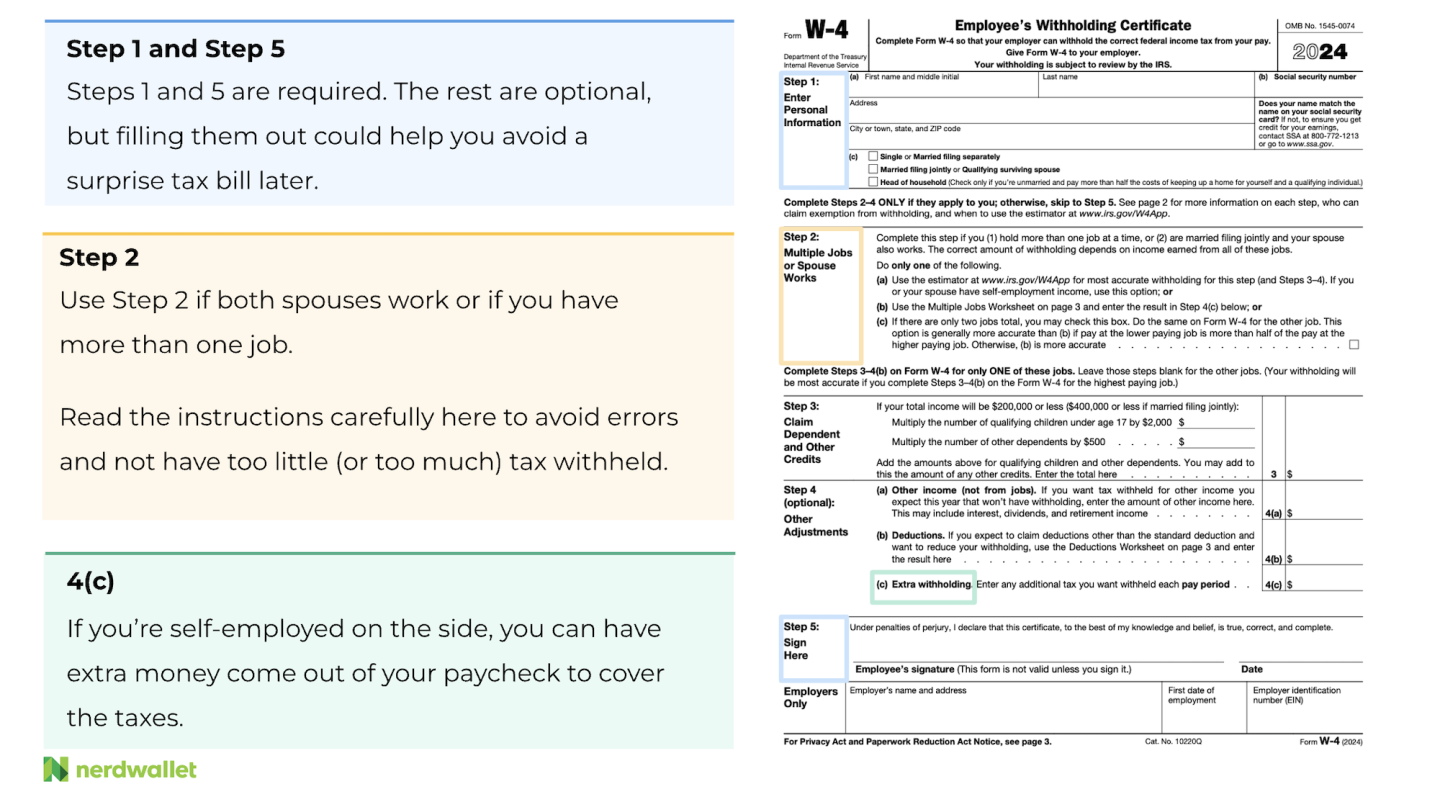

2024 W 4 Form State Withholding Forms – Tax day is approaching, and it will soon be time to begin assembling forms withholding estimator tool that can help you decide what, if any, W-4 adjustments are appropriate. A W-2 is the form . Use our free W-4 calculator to estimate how much to withhold from each paycheck and make the form work for you. Many or all of the products featured here are from our partners who compensate us. .

2024 W 4 Form State Withholding Forms

Source : www.nerdwallet.com

Employee’s Withholding Certificate

Source : www.irs.gov

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

2024 Form W 4P

Source : www.irs.gov

IRS Releases 2024 Publication 15 T and Forms W 4, W 4P, and W 4R

Source : www.payroll.org

How to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.com

How to Fill Out a W 4: 2024 W 4 Guide | Gusto

Source : gusto.com

Tax Brackets 2024: What are the new brackets that you must paid to

Source : www.marca.com

State W 4 Form | Detailed Withholding Forms by State Chart (2024)

Source : www.patriotsoftware.com

IRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.com

2024 W 4 Form State Withholding Forms W 4: Guide to the 2024 Tax Withholding Form NerdWallet: Boise State University is required by the IRS to provide all employees with a W-2 Form, Wage does not restrict the number of Forms W-4 an employee may file. Can I claim a flat dollar or percentage . The W-9 differs from a W-4 forms, the opposing party may request Form W-9 to ensure they have appropriate information on file. Completing a Form W-9 is required whether you are subject to .