2024 Federal W 4 Form – Use of New Forms W-4P and W-4R Is Important to Avoid Liability Internal Revenue Code Section 3405(d)(2) imposes secondary liability on a plan administrator for the withholding and deposit of the . An employer will issue a Form W-2 to you if you are an employee. Here’s a look at what you need to know about your Form W-2 for the current tax season. .

2024 Federal W 4 Form

Source : www.irs.gov

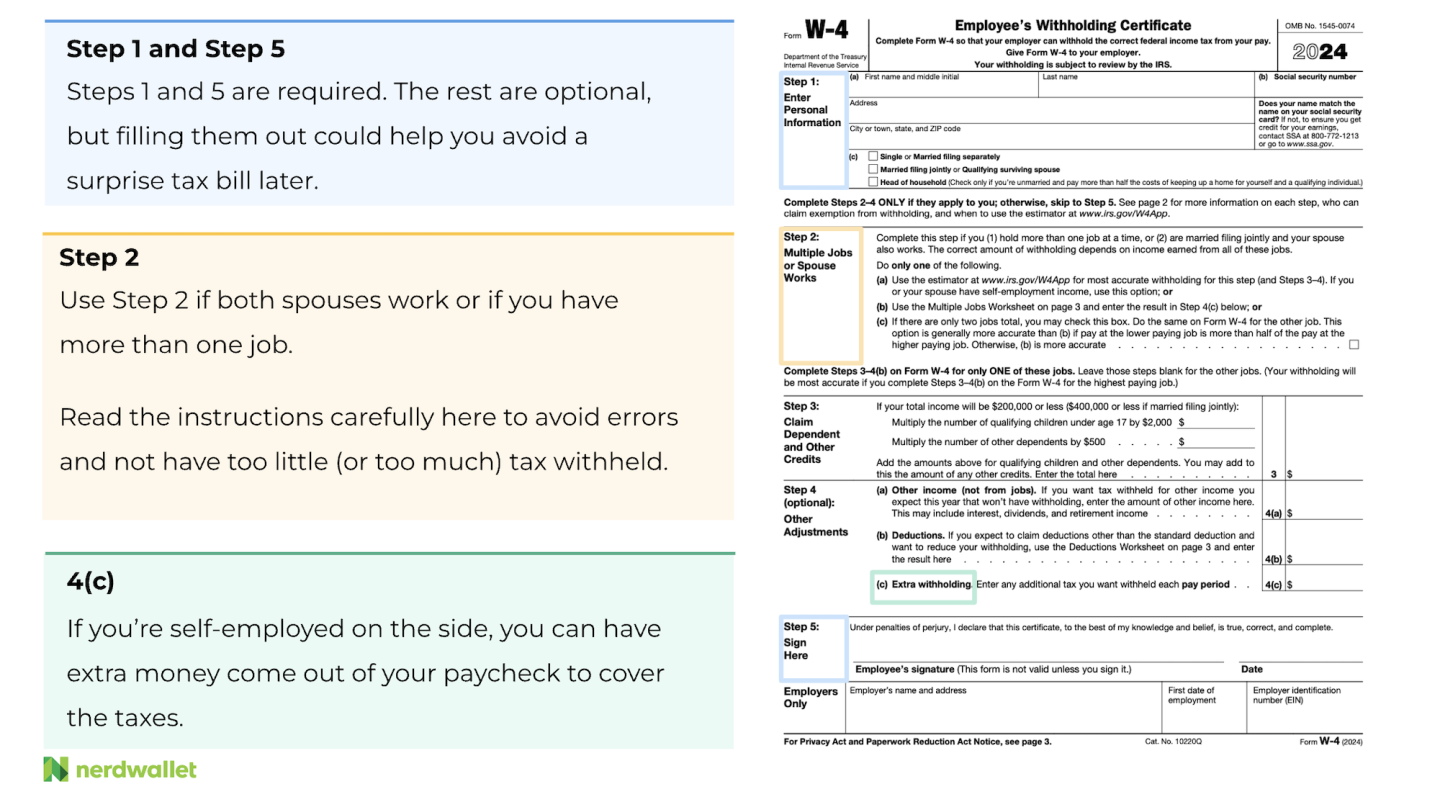

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

How to Fill Out a W 4: 2024 W 4 Guide | Gusto

Source : gusto.com

2024 Form W 4P

Source : www.irs.gov

How to Fill Out a W 4: 2024 W 4 Guide | Gusto

Source : gusto.com

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

How to Fill Out a W 4: 2024 W 4 Guide | Gusto

Source : gusto.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

How to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.com

2024 IRS Form W 4: Simple Instructions + PDF Download | OnPay

Source : onpay.com

2024 Federal W 4 Form Employee’s Withholding Certificate: The 2024 tax-filing season opens on Jan. 29. Be on the lookout for a W-2 from your employer, as well as various 1099 forms. Some of those forms might arrive in the mail or show up in your email, but . Tax filing season for Rhode Island starts on Jan. 29. For those who don’t want to pay to file their taxes this year, there are ways to file for free. .